Maksimer verdien avMaksimer verdien avkredittkortetkredittkortetditt medditt medBill KillBill Kill

Bill Kill - stedet der betalinger blir til minner.

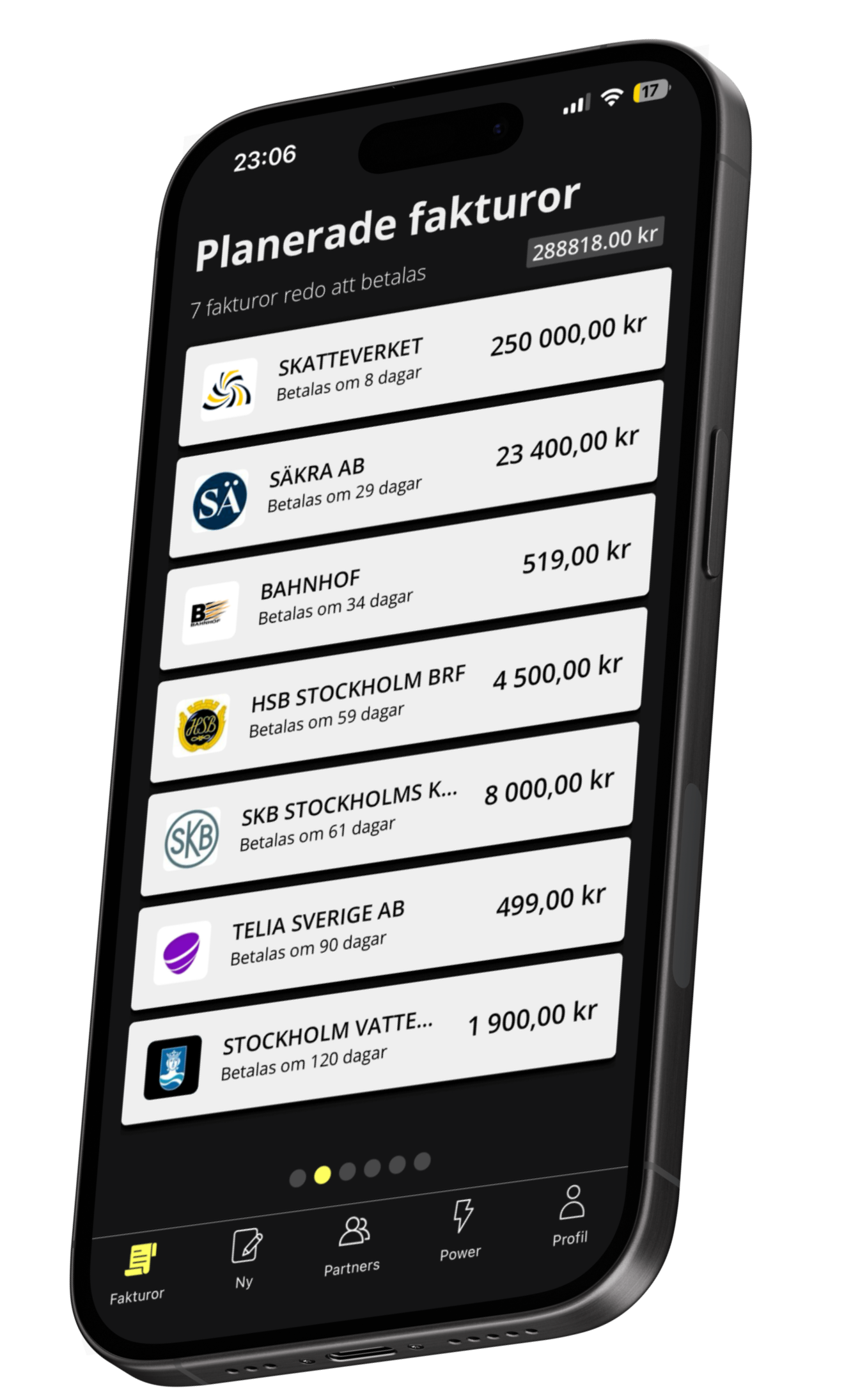

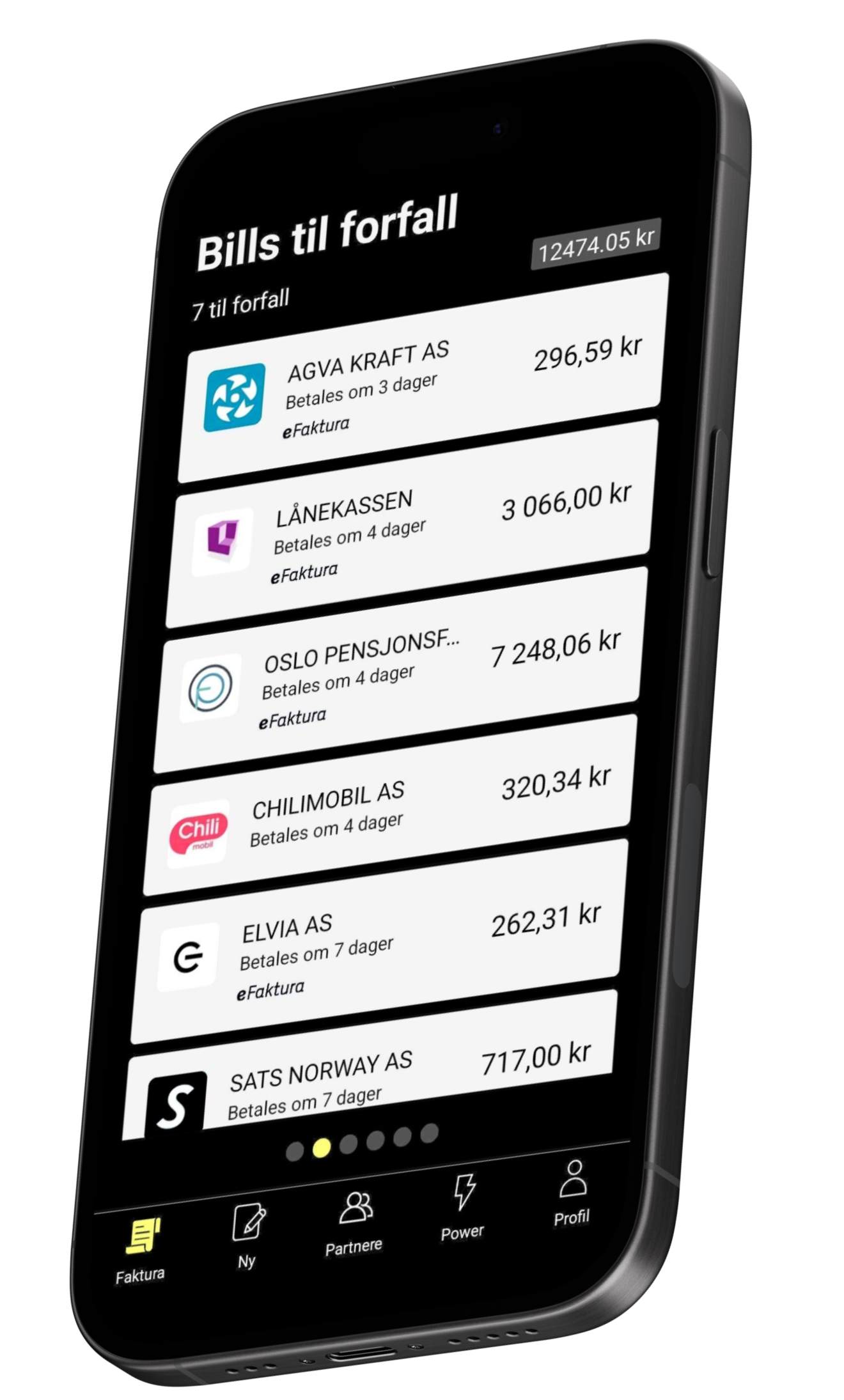

Med Bill Kill kan du betale faste kostnader med debetkort/kredittkort og opptjene kortfordeler, slik at du får mer ut av hver betaling.

Alt avhenger av hvilket kort du bruker og hvordan du bygger opp fordelene dine. Du kan reise komfortabelt i Business eller First Class, opptjene nivåpoeng hos SAS, besøke drømmedestinasjoner, oppgradere flybillettene dine og hotellopphold, få tilgang til lounger og benytte to til en reiser. Kortfordelene kan også gi mulighet for eksklusive middager og andre fordeler.

Hva venter du på?

.png)

.svg)